Professional Development Programme (PDP)

The Hong Kong Monetary Authority (HKMA) works with the Hong Kong Institute of Bankers (HKIB) and Hong Kong Applied Science and Technology Research Institute (ASTRI) to develop a localised certification scheme – Certified Cyber Attack Simulation Professional (CCASP) and training programmes for cybersecurity professionals.

CCASP is supported by the Council of Registered Ethical Security Testers (CREST) International.

Certified Cyber Attack Simulation Professional (CCASP) Certification

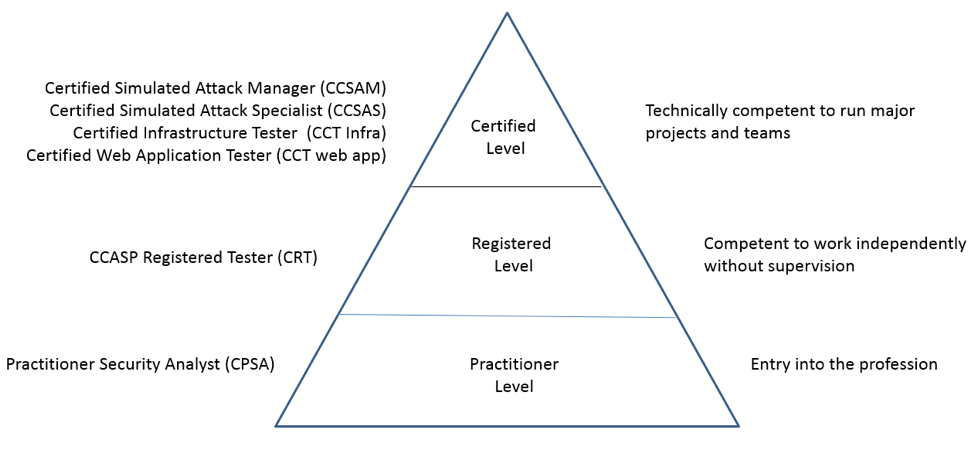

CCASP/CREST examinations are recognised by the professional services industry and buyers as being the best indication of knowledge, skill and competence. They are a high-level aspiration for those taking them and increasingly a mandated requirement for those hiring or buying services. CCASP/CREST examinations are broken down into three levels.

CCASP/CREST provides a recognised career path right from your entry into the industry through to experienced senior tester level. We work with the largest number of technical information security providers who support and guide the development of our examination and career paths.

Different Levels of CCASP

The CCASP Practitioner examinations are the entry level examinations and are aimed at individuals with around 2,500 hours relevant and frequent experience.

The CCASP Registered Tester examinations are the next step and by passing this you are demonstrating your commitment as an information security tester. Typically, candidates wishing to sit a Registered Tester examination should have at least 6,000 hours (three years or more) relevant and frequent experience.

The CCASP Certified Tester examinations are designed to set the benchmark for senior testers: These are the certifications to which all testers aspire. By gaining the CCASP Certified Tester certification you are recognisably at the top of your game as an information security specialist.

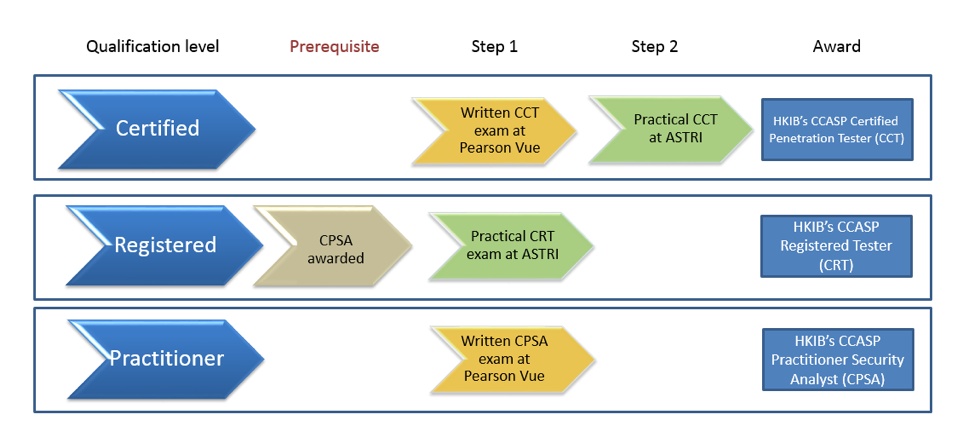

Route to CREST/HKIB’s CCASP Certification – Penetration Tester

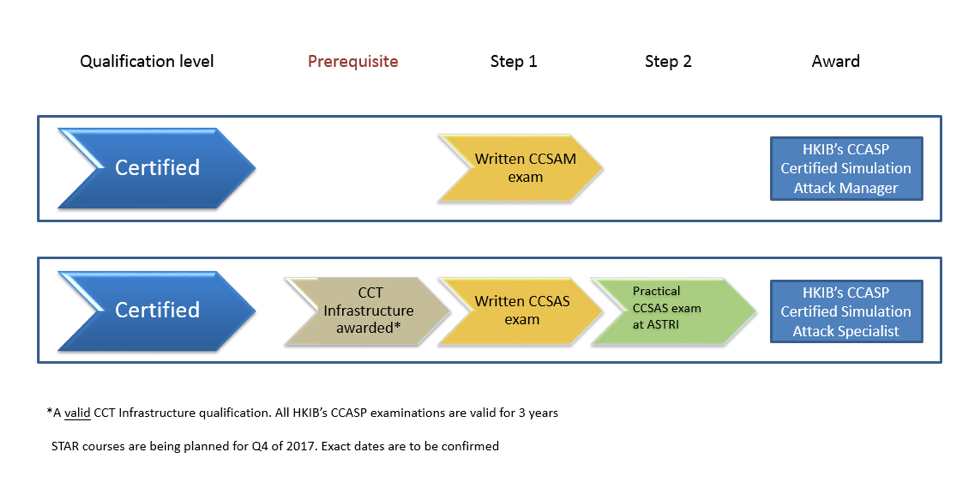

Route to CREST/HKIB’s CCASP Certification – Simulation Target Attack and Response

ASTRI Cyber Range Laboratory

Established in July 2016, ASTRI Cyber Range is Hong Kong’s first laboratory equipped to monitor and simulate cyber attacks. The Cyber Range is a collaboration between ASTRI and Hong Kong Police Force with an aim to provide state-of-the-art training programmes to cybersecurity practitioners in law enforcement agencies and financial institutions.

Enquiries

To enroll and find out more details on the upcoming training or examinations, please visit the HKIB website at https://www.hkib.org/.

If you have any other questions, please contact us

- General enquiries – Tel: 2153 7800 or Email: [email protected]

- Technical enquiries – Email: [email protected]